1031 Exchange services in Mandeville

Looking to optimize your investment portfolio?

We are Mandeville's leading title firm specializing in 1031 exchange and business law

for buyers

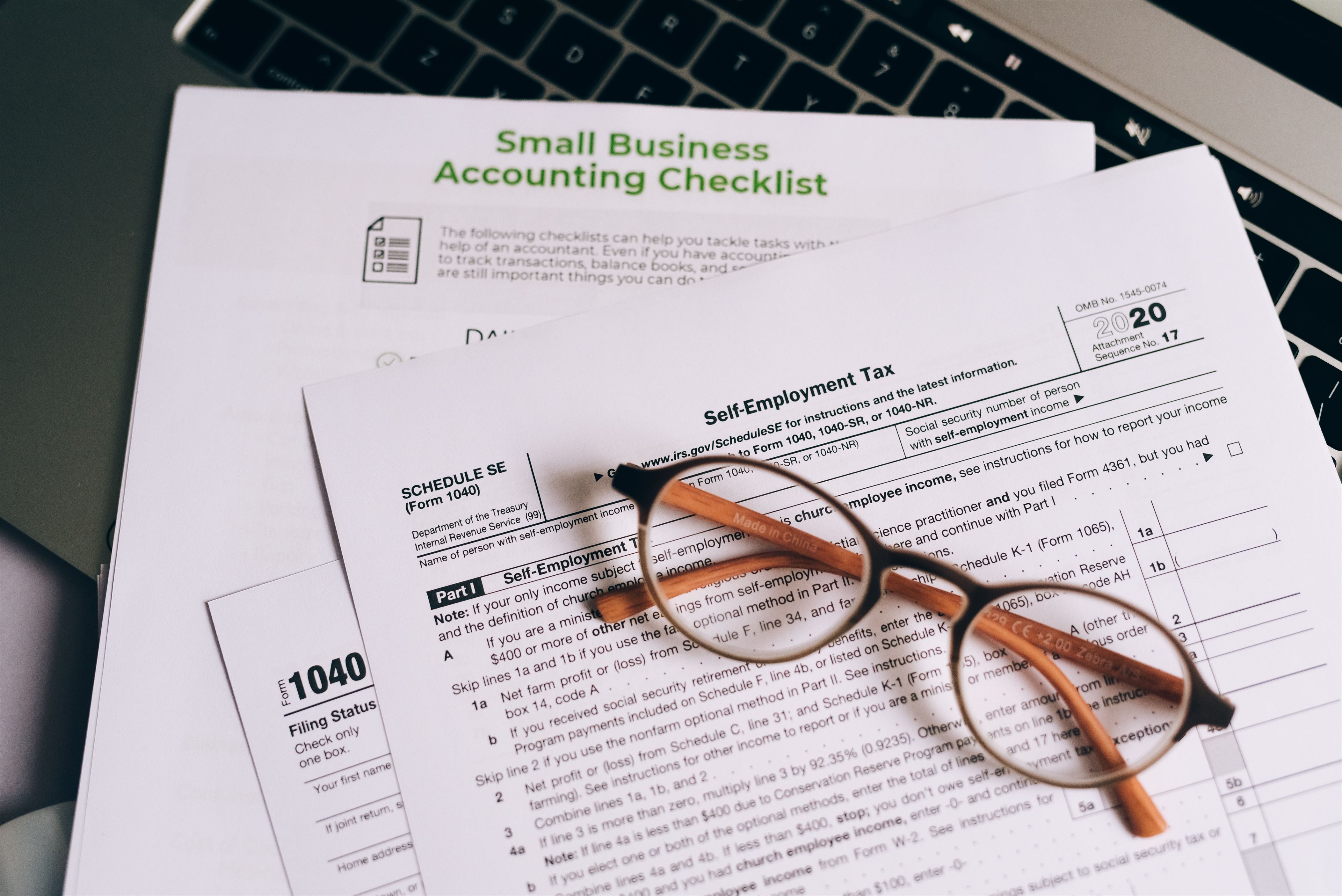

Generally, when you sell real estate held for investment or business use, you have to pay tax on the gain from the sale of your property. However, the tax deferred exchange, as defined in Section 1031 of the Internal Revenue Code, offers taxpayers a great opportunity to build wealth and save on taxes.

This allows the "Exchanger" to defer capital gain taxes on real estate held for investment indefinitely if the owner of the qualifying property exchanges, rather than sells it. As such, with a 1031 exchange transaction, one can dispose of investment or business-use assets, acquire replacement property and defer taxes that would otherwise be due if sold.

What is a 1031 exchange?

The 1031 exchange is a tax-deferred exchange that allows you to swap one investment property for another without incurring capital gains tax.

It is important to note that a 1031 exchange is not a tax loophole. By taking advantage of this IRS code, you can defer taxes and reinvest the proceeds from the sale of your property into a new one that better suits your investment goals.

Requirements for a qualified 1031 exchange in Mandeville

- Like Kind Requirement:

The property must be like kind, and must be held for investment or in connection with a trade or business but do not have to be similar use (exchange raw land for an apartment building). - Same Taxpayer Requirement:

The taxpayer must acquire title to the replacement property in the same manner as title was held to the relinquished property.

Potential Exception: Single member LLC of which the taxpayer is the sole member. - Identification Rules:

There are 2 rules to choose from: The 3 Property Rule or the 200% Rule.

The 3 property rule allows you to to pick up to 3 properties that can be identified without regard to their fair market value.

The 200% rule lets you identify any number of properties as long as their combined fair market value does not exceed 200% of the fair market value of all relinquished property. - Deadlines:

There are 2 deadlines, both of which begin on the date of transfer of the first relinquished property.

The first is the identification deadline which has to be within 45 calendar days in which the Exchanger must identify the Replacement Property to be acquired.

The second is the exchange deadline where the exchange must be completed by the earlier of 180 calendar days from the first relinquished property closing or the due date (including extensions) for the Exchanger's federal tax return for the year.

Requirements for fully deferred 1031 exchange in Mandeville

- The replacement property or properties must be equal or greater in value than the value of the relinquished property.

- The amount of equity in the replacement property must be equal to or greater in value than the value of the amount of equity in the relinquished property.

- The Exchanger cannot receive any non-like kind property such as cash from the sale of the relinquished property or taking back a Promissory Note from the buyer of the relinquished property.

Whether you're a seasoned investor or just starting in the world of real estate investments, our 1031 exchange title service in Mandeville is here to help you achieve your investment goals while minimizing your tax liability.

Contact us today to learn more about how we can assist you in your next 1031 exchange

See also:

Office

502 Water St,

Madisonville, Louisiana

70447